The Mineral Report is a publication by the National Mining Agency (ANM) that presents estimates of the behavior of the general level of mineral production, through the Mineral Production Indicator (MPI), the performance of foreign trade and the labor market, as well as the collection of specific revenues from the country’s mineral industry (CFEM and TAH). It used to be biannual, but as of July 2021 it will be quarterly.

Mineral Production Level

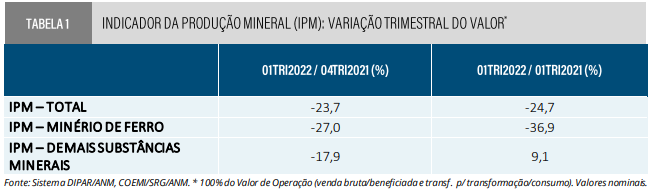

The IPM-Total in the 01TRI2022 (R$ 54.2 billion) decreased 24.7% in comparison with the previous quarter and 23.7% in relation to the same period in 2021, in nominal values. The retraction observed in the IPM-Total is a direct reflection of the drop in the IPM-Iron Ore, the main component of the IPM-TOTAL.

For the other substances, the operation value (R$ 20.8 billion) in the 01TRI2022 showed a growth of 9.1% when compared to the same period of the previous year (R$ 19.1 billion) and a retraction of 17.9% when compared with the 04TRI2021 (R$ 25.4 billion), as shown in Table 1.

External Commerce of the Mineral Sector

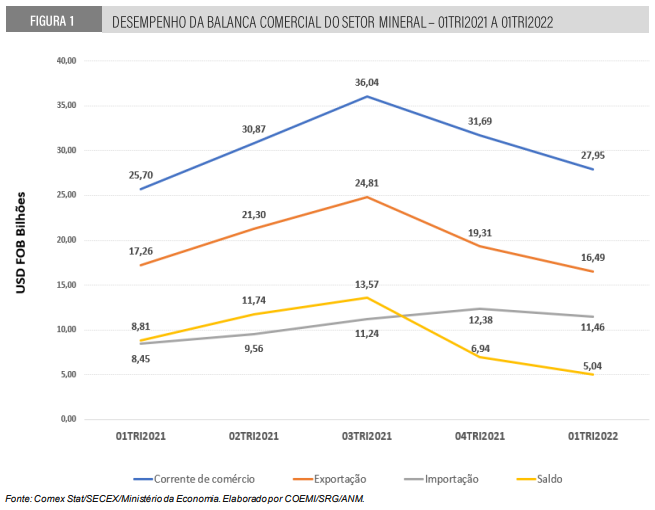

The trade balance of the Mineral Sector (SM)1 showed a surplus balance of USD FOB 5.04 billion in 01TRI2022, i.e. 41.7% of the total surplus balance of Brazil’s trade balance (USD FOB 12.10 billion).

Exports totaled USD FOB 16.49 billion (22.7% of Brazil’s total) and imports were USD FOB 11.46 billion (18.9%). There was a reduction, respectively, of 4.4% in exports in relation to 01TRI2021 (USD 17.26 billion) and of 14.6% in relation to 04TRI2021 (USD 19.31 billion).

In imports, there was an increase of 35.7% in relation to the 01TRI2021 (USD 8.45 billion), and a reduction of 7.5% in relation to the 04TRI2021 (USD 12.38 billion).

Mineral Extractive Industries – IEM

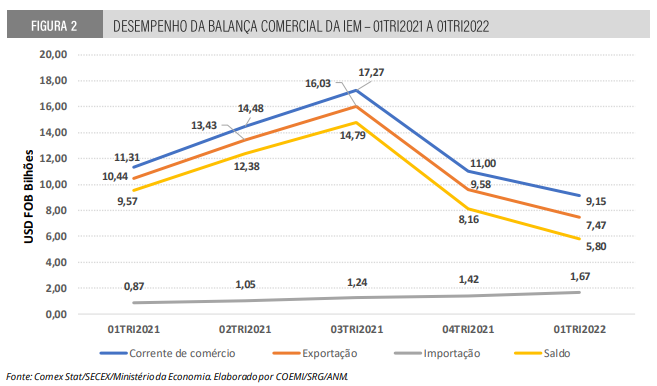

The Mineral Extractive Industry (MEI) trade balance had a surplus balance of USD 5.80 billion in 01TRI2022, 47.9% of Brazil’s trade balance surplus (US$ 12.10 billion) in the period.

The 01QRI2022 data shown in Figure 2 indicate that the trade flow accounted for 6.8% of Brazil’s total in the period (US$ 133.09 billion).

In addition, exports from the EMI supplied 10.3% of the total USD FOB 72.28 billion of Brazilian exports, but suffered a decrease of 22.4% compared to 04TRI2021 and 28.9% compared to 01TRI2021.

In turn, imports made up 2.8% of the Brazilian total of US$ 60.50 billion in the quarter, an increase of 17.4% compared to the previous quarter and 92% when compared to 01QRI2021.

Notable in the quarter were the devaluations of the Brazilian real (R$ 5.22/USD) and iron ore (USD 142.48/t) compared to 01QRI2021 (R$ 5.48/USD and USD 167.20/t), according to the Brazilian Central Bank and the World Bank.

Data from COMEXMIN highlight the largest exporting states of goods from IEM in 01TRI2022: Pará (USD 3.37 billion, 48.2%), Minas Gerais (USD FOB 2.71 billion, 38.9%) and Espírito Santo (USD FOB 0.56 billion, 8.5%).

Among the main ports of exit are the Port of São Luís/MA (46.0%), Port of Vitória/ES (20.4%) and Port of Itaguaí/RJ (18.2%), totaling USD 6.33 billion, or 85.5% of IEM’s exports.

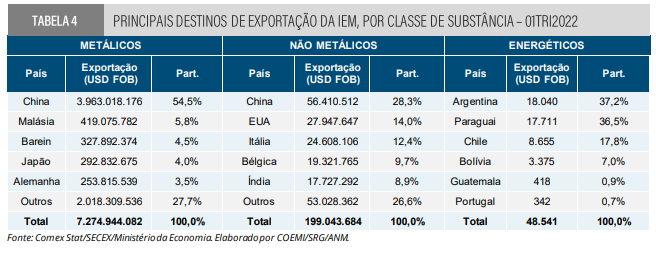

The main destination country of Brazilian exports of MEI was China (Table 4), responsible for absorbing

53.8% of foreign sales (US$ 4.0 billion) during 01QRI2022, followed by Malaysia (5.6%) and Japan (4.0%).

Collection of CFEM and TAH

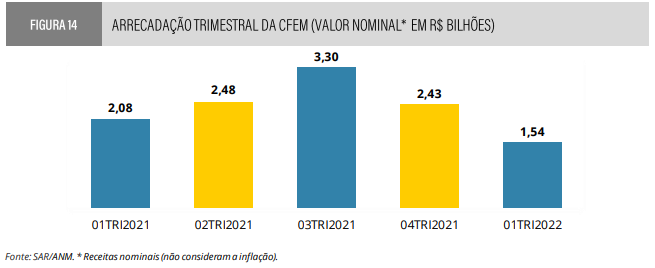

The Financial Compensation for the Exploration of Mineral Resources (CFEM), a mining sector royalty, and the Annual Fee per Hectare (TAH), charged annually at the mineral research stage, account for 99% of ANM’s collection.

In the 01QRI2022, the collection of CFEM totaled R$ 1.54 billion. Compared to 01QRI2021, nominal revenues (not considering inflation) fell 25.9%, and there was a 36.6% drop compared to the last quarter of 2021.

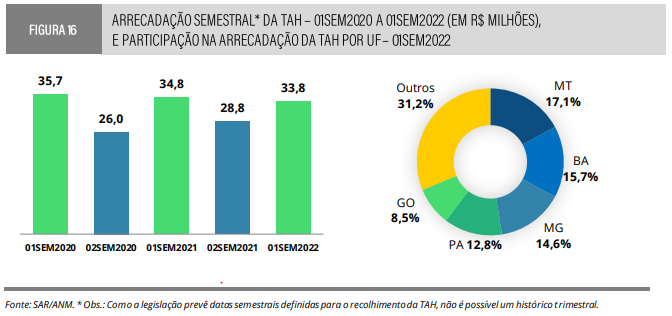

The five states that collected the most TAH in the 1st half of 2022 were Mato Grosso (17.1%), Bahia (15.7%), Minas Gerais (14.6%), Pará (12.8%), and Goiás (8.5%), which accounted for 68.8% of all TAH in the 1st half of 2022.

More detailed information about the Mineral Report 1tri2022 can be accessed in full by clicking here.

Research Source:

ANM Portal, National Publications – Mineral Report – 2022 1st Quarter